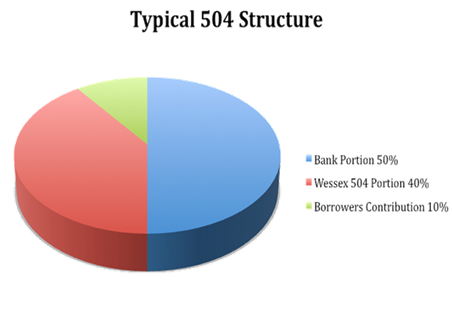

Typical Financing Structure of the 504

- Bank or other lender finances 50% of the project cost and takes a first lien position on the financed assets

- Wessex 504 Corporation, through the SBA 504 loan, finances 40% of the project costs (maximum Wessex 504 portion is $5 million or $5.5 million for manufacturers) and takes the second lien position

- Business Owner contributes low down payment of 10% of project costs

Typical Project

| Cost | |

| Purchase building | $7,000,000 |

| Renovations | $650,000 |

| Equipment | $300,000 |

| Soft costs | $50,000 (i.e. appraisal, architect fees, closing costs) |

| Total: | $8,000,000 |

| Financing | |

| Bank - first mortgage | $4,000,000 (50%) |

| SBA 504 - second mortgage | $3,200,000 (40%) |

| Business down payment | $800,000 (10%) |

| Total: | $8,000,000 |

Key Advantages of SBA-504 loan over traditional business loans

- Low down payment - The business owner puts only 10% down, borrowing up to 90% of the total financing needs, thus preserving valuable working capital for the business.

- Long term financing - Repayment periods are longer than conventional bank loans - 20 years fully amortized for real estate loans (10 years for equipment only loans). The borrower's monthly loan payment is more affordable, improving cash flow.

- Below-market, fixed interest rate -The below market, fixed interest rate protects against future rate fluctuations, providing low and predictable monthly payments.

Terms, Rates and Fees

- The bank portion of the loan is typically amortized with a minimum term of 10 years up to a maximum of 25 years. Rate term and fees are negotiable between the borrower and bank. The bank is responsible for an SBA first mortgage lender fee, which is 0.50% of the bank loan.

- The Wessex 504 loan is a 20 year fixed rate loan (10 years for equipment only loans). The interest rate on a 504 loan is based on the current market rate for five-year and ten-year U.S. Treasury issues. All fees are financed into the 504 loan, with the exception of the $2,000 application fee.